Our third fund, the Equity Platinum Fund 2, is purchasing exclusive luxury vacation residences in Hawaii, California, the Caribbean, and other highly coveted vacation destinations. This fund is currently open to new investors.

Equity Platinum Fund 2’s target raise is $50 million from accredited investors to acquire up to 16 multi-million-dollar luxury investment homes in top-tier vacation destinations. The residences will feature prime locations, such as ski-in ski-out and beachfront while also providing access to private club amenities, golf course privileges, and more.

Equity Platinum Fund 2 investors will own a diversified portfolio of 16 luxury vacation homes spanning locations from Hawaii to Europe. The homes will either be pre-construction or well-maintained resales and include a wide range of amenities and services for guests.

Equity Platinum Fund 2 is a luxury real estate private equity fund and an investment vehicle that allows multiple investors to pool their capital and co-own a portfolio of vacation homes. Our investors can benefit from the rental income from these homes and take rent-free vacations across all Equity Residences portfolios.

Managed by a team of experienced finance, hospitality, and real estate professionals with a successful track record in the industry

The fund operates debt-free and acts as a capital preservation play for investors who want to diversify their portfolios with luxury vacation homes in the world’s top destinations

No annual fee option (annual fees can be offset through a reduction in vacation use)

Dividend opportunity based on excess rental income

>90% of capital invested in real estate

Investment in “bought-right,” multimillion-dollar vacation residences with high potential for investment gains

Liquidation and profit distribution within a set time frame

Rent-free luxury vacations with friends and family in any of the portfolio homes

No blackout dates. You have the freedom to use the residences for holidays or whenever it suits you.

Access to hundreds of luxury homes around the world through partnerships with Elite Alliance and THIRDHOME

Personal concierge services including a personal chef, pre-stocked refrigerator and access to sports and leisure equipment

Equity Residences Managing Directors John Long and Greg Salley hold a 52-minute webinar that discusses the company’s business model and introduces the Equity Platinum Fund 2 to potential investors.

Equity Platinum Fund 2 investors will own a diversified portfolio of 16 luxury vacation homes ranging in locations from Hawaii to Europe. These various types of homes are well-maintained and include a wide range of amenities and services to guests. With a portfolio of 16 homes located in some of the most desirable locations in the world, investors can benefit from diversification and the potential for higher returns through vacation home ownership.

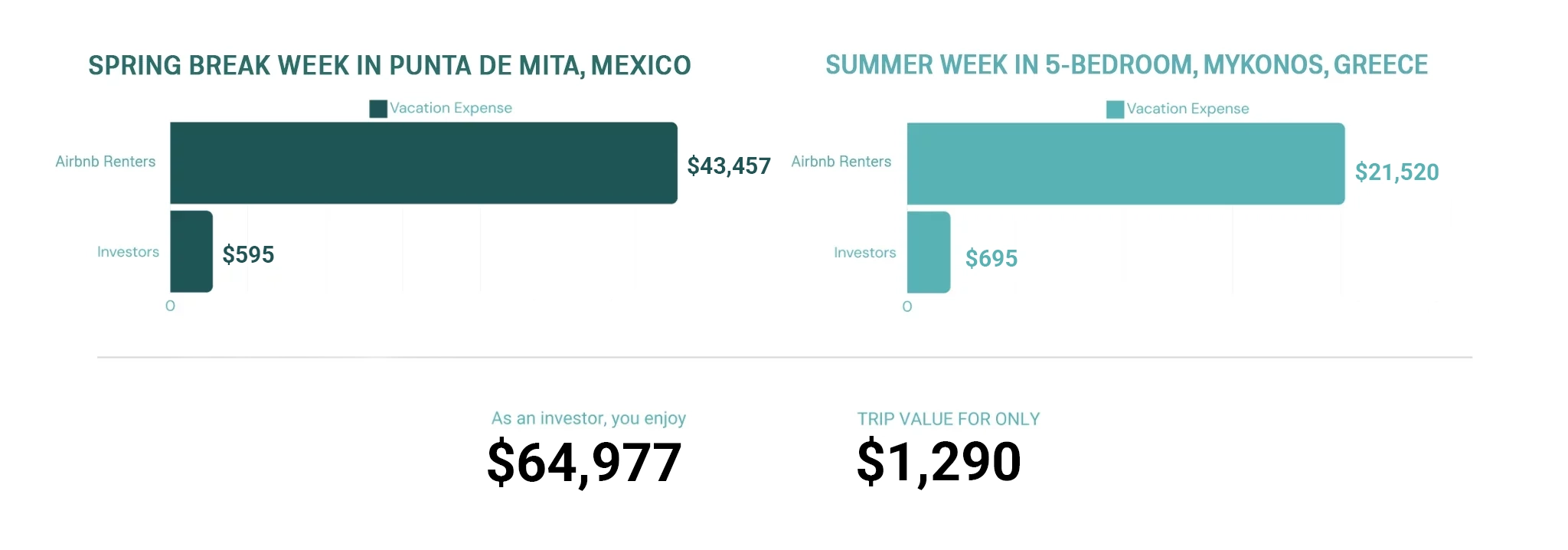

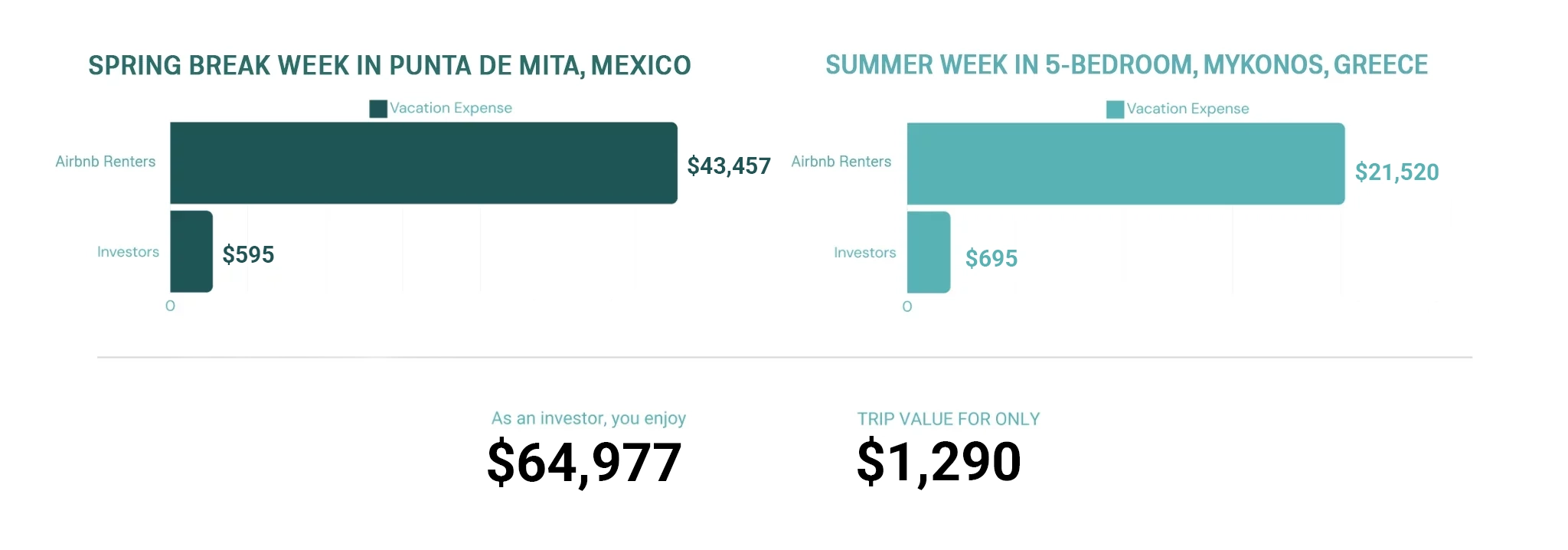

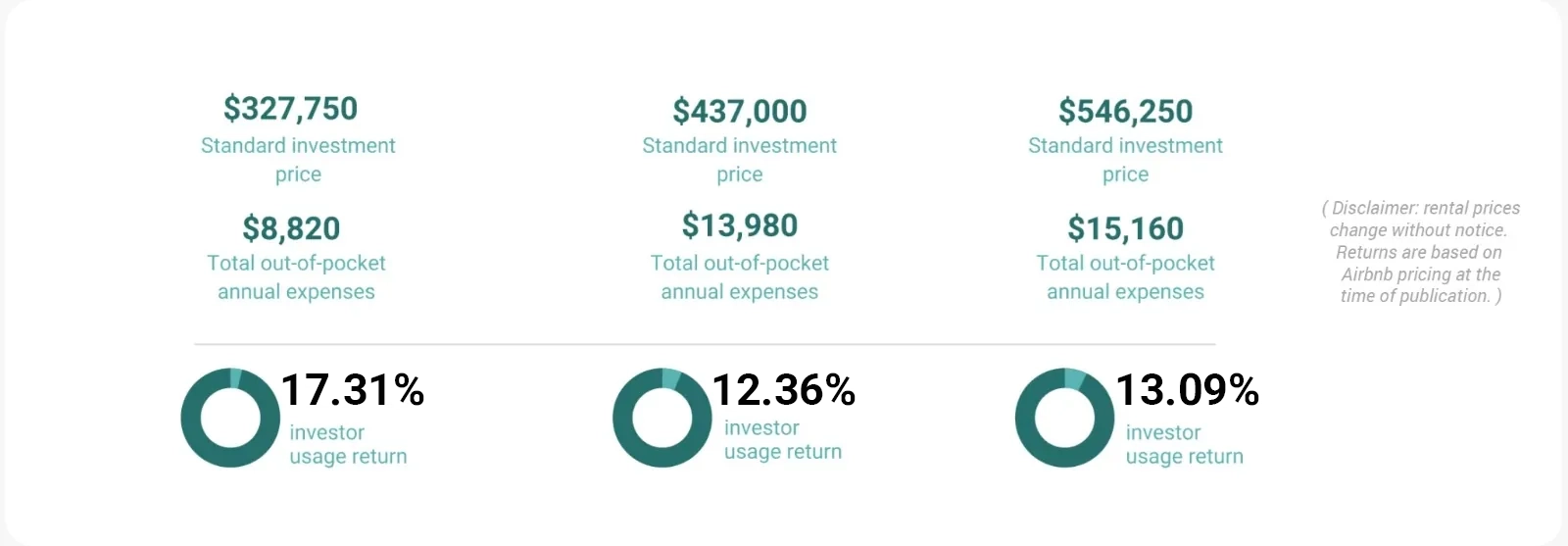

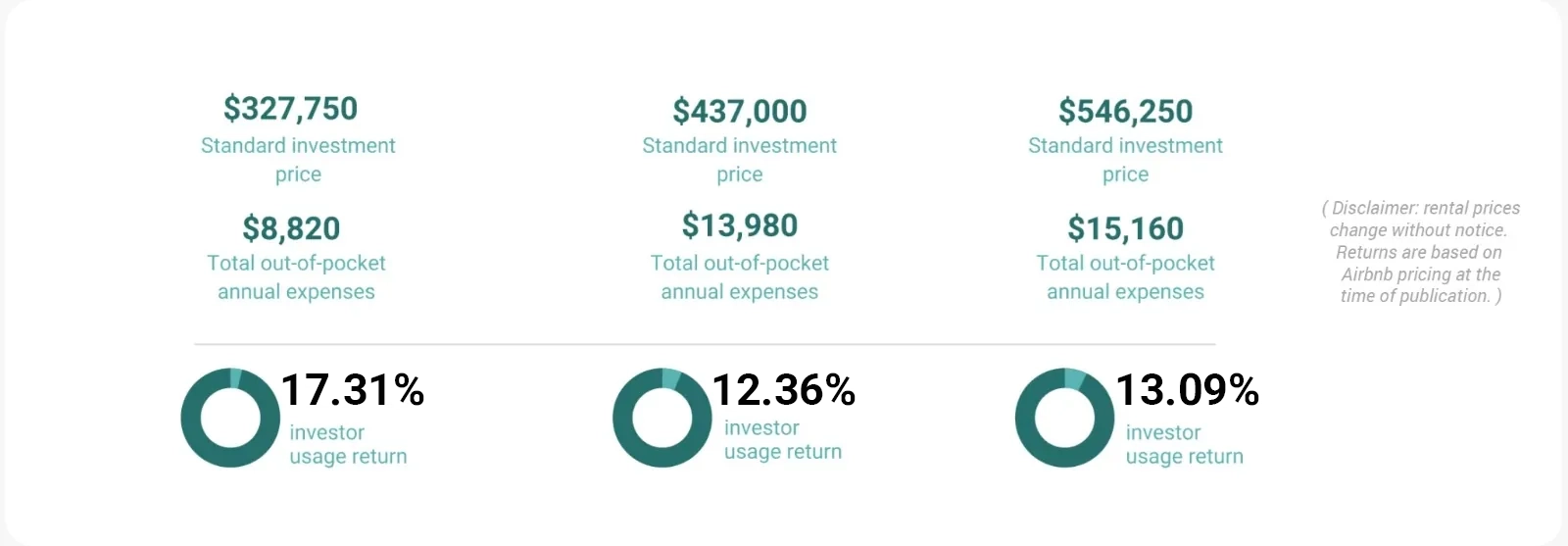

This infographic shows examples of how, as an investor with Equity Residences, you can enjoy top- tier vacation homes at a fraction of the cost renters pay while securing promising returns on your investment.

Please watch this VIDEO to learn more about fund credits.

Yes.

Yes, all Equity Residences investment funds have reciprocal relationships. As an investor, you can book a home in any other fund.

When you join Equity Platinum Fund 2, you will receive a complimentary THIRDHOME membership for one calendar year. During that first year, you can book 60-day short-notice trips at a nominal cost to you through their website. After your initial year with ThirdHome, you can choose to buy their membership for yourself and pay a low negotiated membership fee.

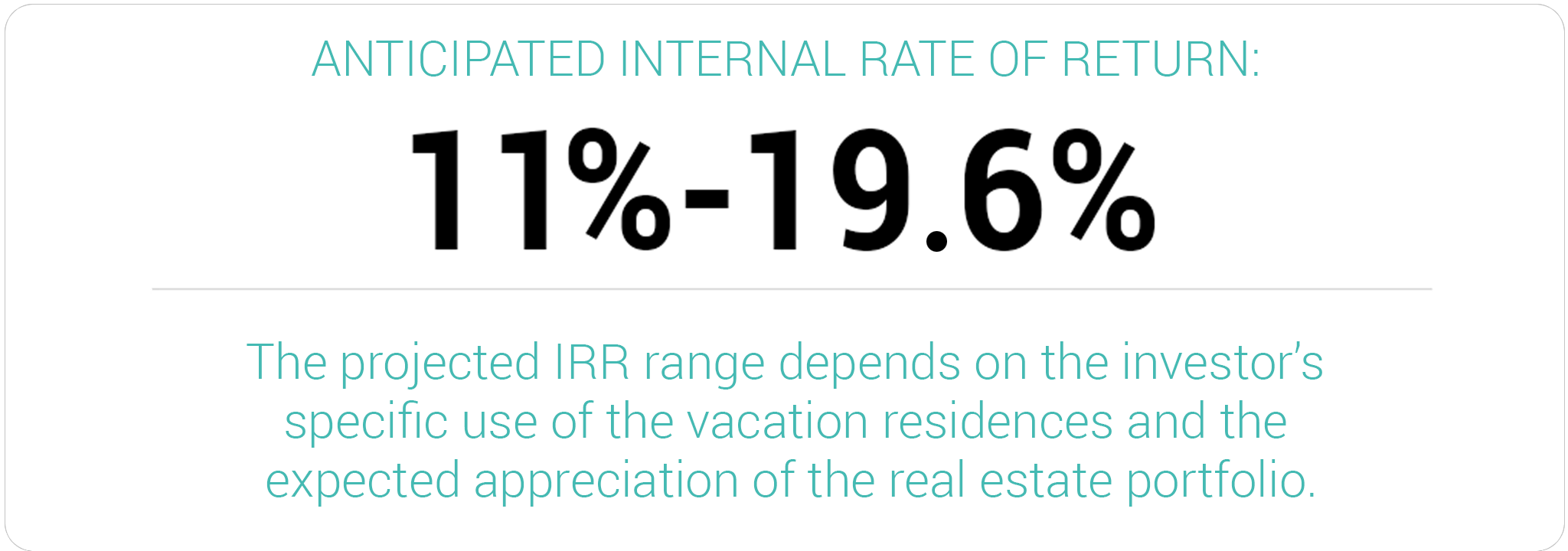

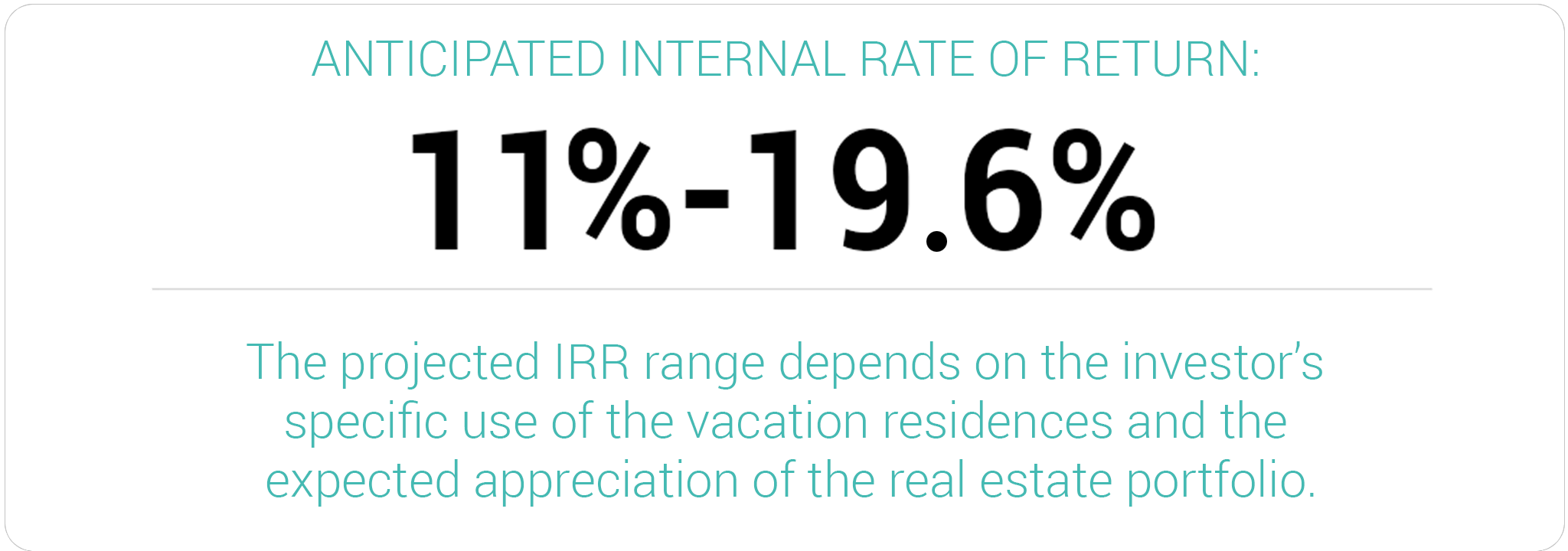

For the Equity Platinum Fund 2, we project a potential return of capital of 1.3x to 1.5x given a 5% per annum real estate appreciation. The portfolio liquidation should start in 2037 after a 5 – year investment period and a 10-year utilization (“hold”) period. The appreciation is split 80%/20% and the management fee is 2% on the funds under management, which is already included in your annual operating fee and is not a separate charge.

No. We buy all of our residences with cash operate with no debt. You can read more about our investment philosophy here.

Yes, we share the audited financials and the latest investor reports with potential investors who are serious about this opportunity.

We do not currently offer 1031 exchanges into our funds.

Equity Residences LLC

500 Westover Drive #12169, Sanford, NC 27330

Tel: +1-619-796-3501

Email: info@equityresidences.com